Autor: Carlos Contreras

In mid-2016, the European Systemic Risk Board (ESRB) established a high-level task force to assess sovereign bond-backed securities’ merits and feasibility.

In the late 2016, the ESRB conducted a public consultation and obtained input and feedback from both the financial industry and public debt management officers (DMOs) regarding the possible development of a market for SBBSs. In May 2018, the European Commission (2018a) presented a “Proposal for a Regulation of the European Parliament and of the Council on SBBS”, as well as a document on the Impact Assessment of SBBSs -European Commission (2018b). Little research has been yet done to analyse this European project. In this brief note, we intend to introduce how the creation of the market for SBBSs has been conceived, and to assess whether this new financial instrument will succeed, under its current conception.

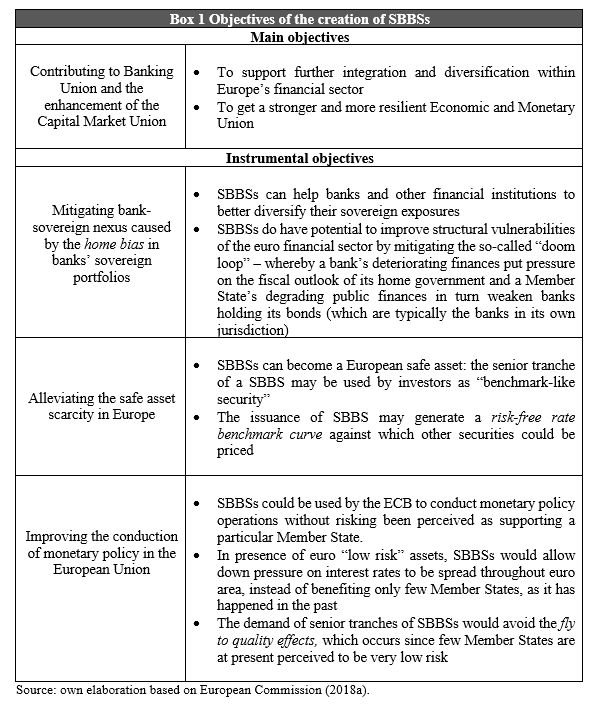

In this regard, first we analyse to what extent objectives pursued by the creation of SBBSs are feasible. From the European Union (EU) perspective, the SBBSs intends to contribute to the consolidation of the Banking Union as well as the enhancement of the Capital Market Union by mitigating the bank-sovereign nexus caused by the home bias in banks’ sovereign portfolios; alleviating the safe asset scarcity in Europe; and improving the conduction of monetary policy in the EU. In Box 1 we offer some details about these targets.

Moreover, in terms of financial market needs, the senior tranches of SBBS might be used to build a risk-free rate curve for the euro. In addition, banks in countries under fiscal stress might avoid what has been called moral suasion situations.

It is worthy to note that although SBBSs have been designed to achieve a stronger and more resilient Economic and Monetary Union, this new financial instrument has not been conceived as a possible solution for sovereign debt crises like the one that started in Europe in November of 2009. In this regard, SBBSs can be seen as a watered-down version of Eurobonds, since they do not involve any mutualisation of fiscal risks among Member States. Under a genuine Euro-bond project, there would be a merge of sovereign debts into one commonly-backed euro-zone debt. Such a new debt instrument would be issued by a newly created common Euro area fiscal authority and debt management agency and would be jointly and severally backed by all countries members of the euro zone. Therefore, in terms of boosting the Fiscal Union, the shooting capability of SBBSs is much less powerful than could have been expected from true Eurobonds. For the same reason, however, in terms of incentives SBBSs would also raise less moral hazard problems.

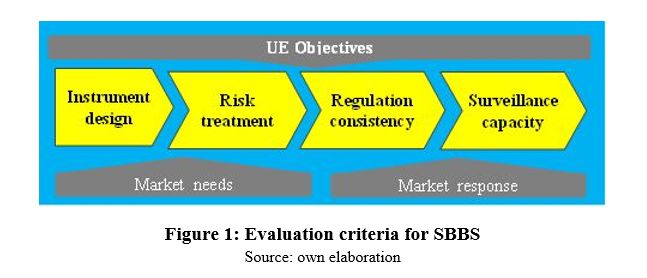

Once objectives have been identified, four criteria could be used to assess whether SBBSs will become a success story, or in other words, whether these instruments will attract enough demand by private investors and private arrangers will have enough incentives to issue them. These criteria include the quality of the instrument’s design; the treatment of risks; the consistency between objectives and regulation; and the capacity of supervision. See figure 1.

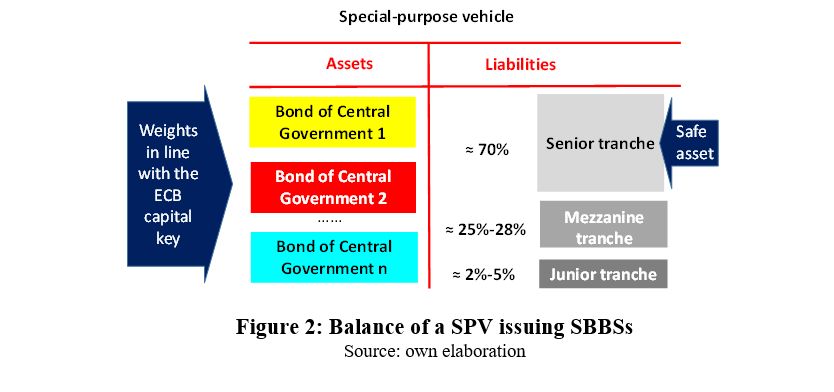

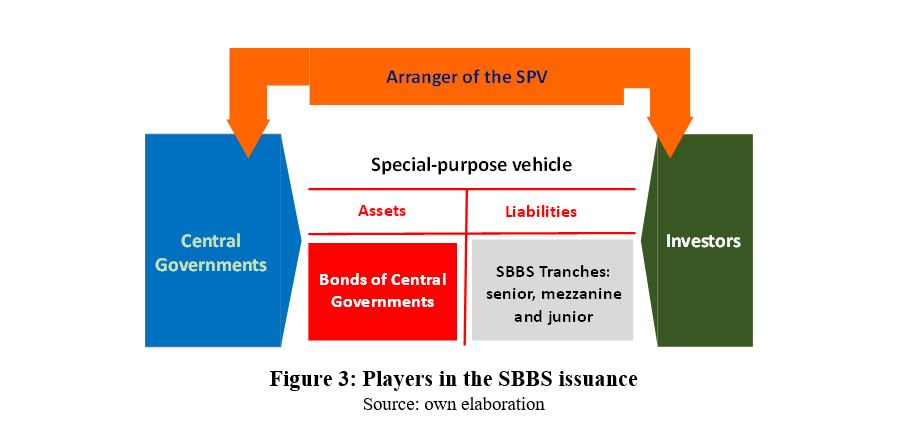

Regarding the instrument design, a sovereign bond-backed security can be defined as a financial instrument, denominated in euro, whose credit risk is associated with the exposures to a portfolio of sovereign bonds (European central government liabilities), issued by a private special purpose (SPV) entity, and that complies with a specific regulation. See figures 2 and 3.

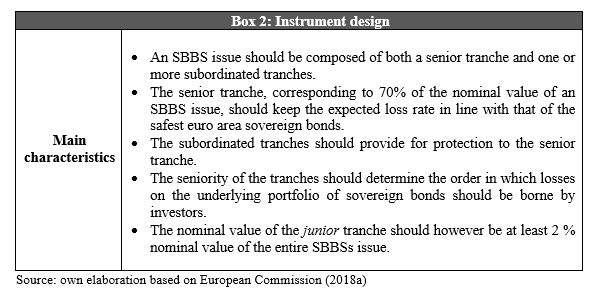

In this regard, main characteristic of SBBSs are show in Box 2.

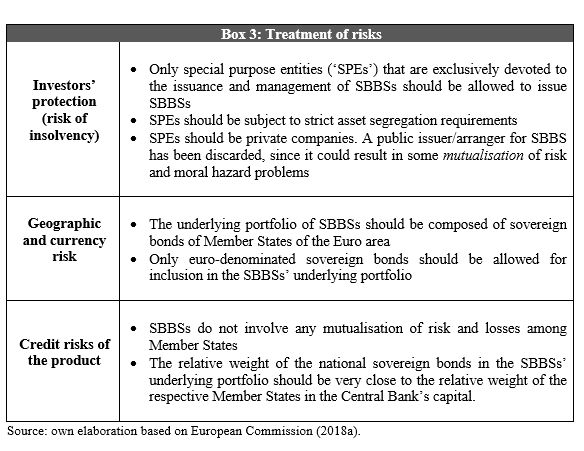

With a view to ensuring the development of this market, the design of SBBSs has included a number of restrictions and conditions that may help the demand for these instruments. In Box 3 we show several features addressing the treatment of risks.

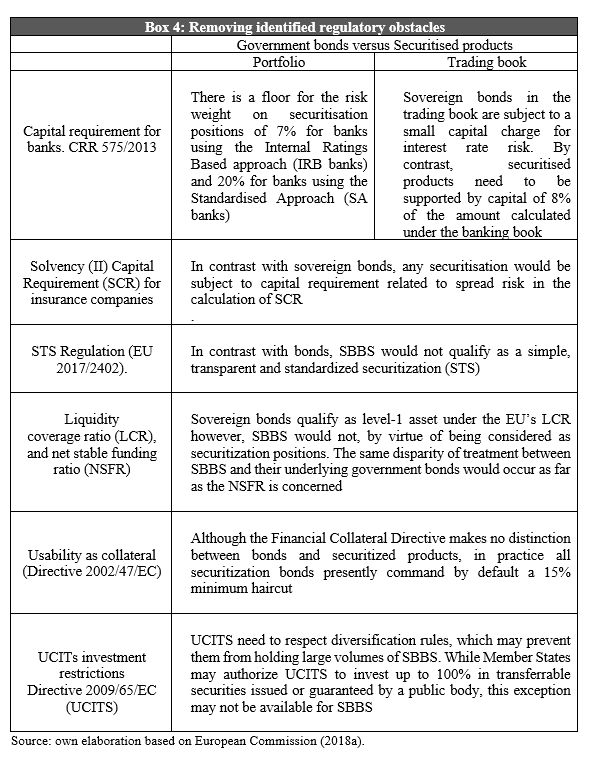

Since the SBBS belongs to the group of securitisation products, the development of its market may be hindered by the fact that in the current regulatory framework, these products attract extra regulatory charges/discounts than direct investments in the corresponding underlying assets. When it comes to securitisation products, the so-called non-neutrality problem relates to the higher requirement of capital, the less eligibility for liquidity coverage and the more limited usability as collateral of these type of financial instruments.

The regulation proposal for SBBS aims to level the playing field by removing unjustified regulatory impediments and granting SBBS the same regulatory treatment as national euro-area sovereign bonds. In the absence of this regulatory framework adequacy there would be no guarantee that a sizeable SBBS’s market emerge. However, at the same time, at an early stage, the European Commission has discarded providing SBBSs a preferential regulatory treatment. The option of providing outright regulatory incentives could result in the creation of a SBBS market faster and at a larger scale, but it has been ruled out in order to avoid the perception of potential bail out processes by European authorities. To some extent, the issue of SBBSs from a public entity has been also discarded, mainly to avoid a potential negative impact on the demand for stand-alone national sovereign bonds and its possible destabilising effect.

In Box 4 we show some of the identified hindrances arising from a non-neutral regulation.

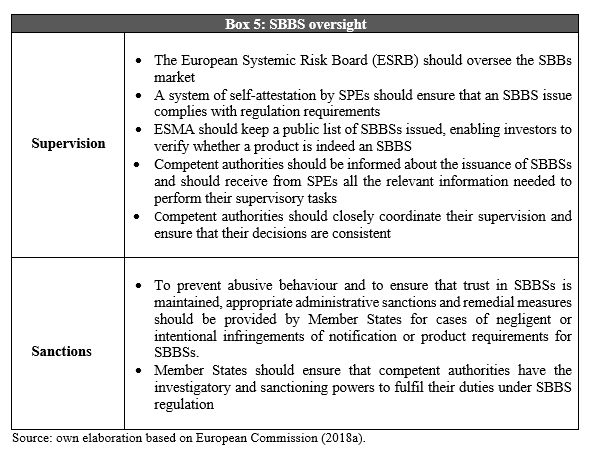

We believe that, removing these obstacles is a necessary condition to restore regulatory neutrality, but it is not a sufficient condition to guarantee the development of a SBBSs robust market. Proper mechanisms of compliance, supervision and sanctions should be also implemented to ensure the development of a vigorous market. In Box 5, we show a number of provisions proposed by the SBBS regulation.

Although our conclusions must be stated with ample qualifications, we believe that:

a. The SBBS project can be considered as a realistic approach: it does not imply mutualisation of sovereign risks, but for the same reason it is no expected to generate moral hazard problems;

b. The development of a European sovereign bond-backed securities market is feasible under the presented design of the European Commission;

c. The private sector could support this market. An investor base might be gradually set up;

d. This market could contribute to a diversification of sovereign bond portfolios held by banks, insurance companies and mutual funds;

e. To some extent, the creation of SBBS could contribute to mitigating some of the structural vulnerabilities of the euro financial sector.

References

– European Commission (2018a) “Proposal for a Regulation of the European Parliament and of the Council on sovereign bond-backed securities”, COM 339 Final.

– European Commission (2018b) Commission Staff Working Document Impact Assessment. An enabling regulatory framework for the development of sovereign bond-backed securities (SBBS). (Accompanying the document “Proposal for a Regulation of the European Parliament and of the Council on sovereign bond-backed securities”) SWD, 252 Final.

Autor:

Carlos Contreras. Licenciado y Doctor en Economía (Universidad Complutense de Madrid) y Master of Science in Economics (University of York). Profesor Titular de Economía Aplicada VI (UCM). Autor de varios libros y artículos sobre finanzas, fiscalidad, deuda pública y política fiscal en Revista de Economía Aplicada , Journal of Public Administration, Finance and Law, Hacienda Pública, Revista de Economía Pública, y otras.