Autor: Carlos Contreras

Autor: Carlos Contreras

The net wealth tax (NWT) is a recurrent tax on the individual net wealth stock (assets net of debts). While this tax is highly disputed, taxing wealth is less so. Individual wealth is commonly taxed in various ways. A tax on capital income can be viewed as a tax on wealth. In several countries, taxes are also levied on lucrative and onerous transfers of wealth. Furthermore, other taxes are imposed on stocks of wealth invested in certain types of assets (e.g., in real estate). In addition, most local governments impose property taxes on an annual basis.

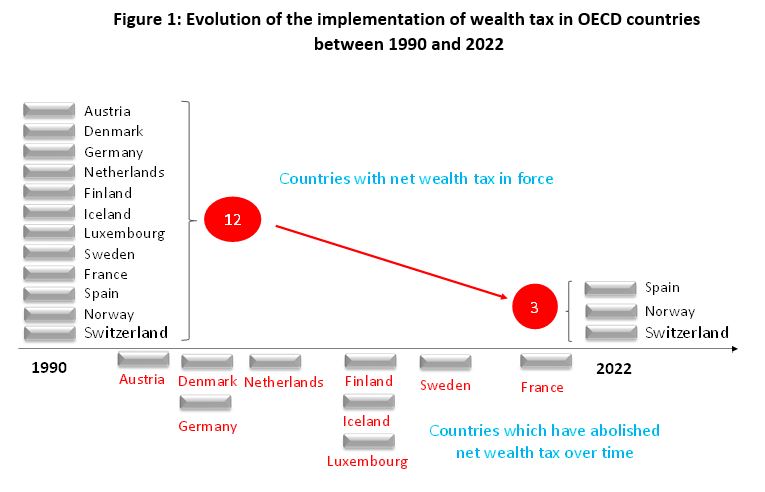

Net wealth taxation has been the subject of controversy for years and in the OECD such taxes are much less common than before. In fact, the NWT is today only in force in a handful of countries. In Europe, this tax was abolished across the board, for example in Austria, Denmark, Germany, Finland, Luxembourg, Sweden, and France. Today, Spain is the only country within the EU where the NWT exists, although it was also not in force between 2008 and 2011. Furthermore, some Spanish regions do not charge it at all, as they apply tax rebates of up to 100% of the quota. Apart from Spain, within the OECD, only Norway and Switzerland maintain such taxation. And Switzerland, as is well known, is a special case.

Recently, some policy makers have placed this tax at the top of their agenda as a chance to fight inequality. In Spain, the government has introduced a second tax on net wealth. In principle, this new tax, called the «Temporary Solidarity Tax on Major Fortunes», would be in force for two years (if not extended) and would apply to net wealth for the years 2022 and 2023. According to the cabinet the new tax purpose is twofold: i) financing new public spending policies linked to the energy crisis and inflation; and ii) harmonising the NWT in the national territory. In relation to the latter issue, it should be noted that the revenue effect of the new tax is not cumulative, as a tax credit is applied on the tax burden of the old NWT. It is expected that this new tax will be challenged as unconstitutional by some Autonomous Communities on the grounds of encroachment of competences. Considering the way in which the regulation has been handled, the new tax will also generate a high level of litigation between individual taxpayers and the tax authority. Furthermore, as tax base deductions are not the same for residents and non-residents with respect to assets held in Spain, the EU is likely to consider this tax discriminatory and an infringement of the free movement of capital within the Union.

In addition to the introduction of a new tax, the law also changes the treatment of non-residents in the old NWT. Before the amendment, residents were subject to wealth tax on any real estate asset directly owned by them in Spain, but the law did not express provision concerning the indirect ownership of such real estate. In accordance with the regulatory change, real estate assets in Spain held by non-residents through non-resident entities are now taxed. This modification appears to be legally protected by Spain’s treaties with several countries on the recognition of sovereignty to tax assets located in one’s own country. However, this measure may also generate litigation to the extent that these treaties do not apply to all countries.

Is there a case for the net wealth tax?

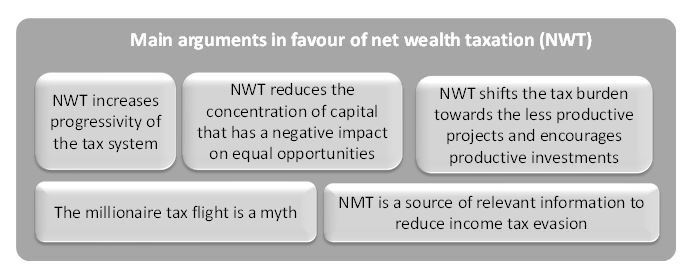

Those who advocate the NWT argue that its establishment prevents capital accumulation, something they consider to be a good idea under the consideration that the concentration of wealth and the rising of inequality may have a negative impact on economic growth. A long-term effect that would operate through its negative impact on equal opportunities. Proponents of this tax also highlight the existence of negative social and political externalities linked to wealth inequality, which must be addressed.

In addition, it is argued that compared to a tax on capital income, the wealth tax shifts the tax burden towards the less productive entrepreneurs and projects.

Moreover, according to some empirical research, wealth taxes would be less harmful to growth than income taxes as the latter affect individual decisions on labour supply and (human) capital investment to a lesser extent.

It has been also argued that although high income and high net worth individuals can move across borders to avoid taxation, in practice the millionaire tax flight is a myth. For the rich, ongoing economic potential is tied to the place where they become successful—often where they are powerful insiders. That success ultimately diminishes both the incentive and desire to migrate.

Finally, one of the arguments in favour of the existence of the net wealth tax is its status as a source of relevant information to reduce income tax evasion

Should net wealth taxation be abolished?

Many economists recommend the abolition of the NWT on the following grounds.

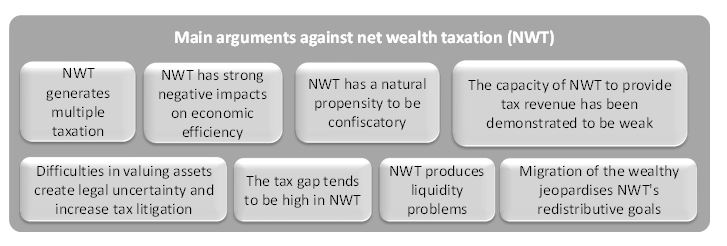

Net wealth taxes generate multiple taxation. Individuals are taxed on their earned labour income. Capital gains from investments accumulated from unconsumed income are taxed again. Ownership of assets is then taxed annually. Finally, taxes are paid posthumously on accumulated wealth. In the view of many scholars, according to pure criteria of justice and tax fairness, this multiple taxation should be eliminated. Although this tax is levied on wealth, it is paid out of income and has a natural propensity to be confiscatory. Technically, therefore, for a net wealth tax to be acceptable, a tax credit for previously paid taxes should be provided.

Wealth taxes are distortionary. In other words, they produce economic inefficiency because the welfare loss they produce exceeds the tax revenue they generate (deadweight loss effect). Most taxes are distortionary, but negative impacts on economic efficiency arising from an NWT are argued to be even greater than those of other alternative taxation. Individuals may be less inclined to take risks in the presence of progressive wealth taxes. Moreover, wealth taxes may have negative effects on labour supply, penalize savings, and, as a result, reduce investment and, ultimately, dampen economic growth.

According to research, the purported negative impact of wealth concentration on economic growth seems to apply only to emerging countries with poor governance.

In practice, the NWT has a restrictive effect on freedom by having a confiscatory impact in the case of unproductive investments.

Another commonly used argument against annual net wealth taxation is that is based on an estimated market value of assets and, as experience has shown, it is difficulty to value assets correctly. It leads to legal uncertainty and a significant increase in tax litigation.

In the same vein, it is argued that the administration of a wealth tax entails high costs for both the government and taxpayers. Several studies have shown that collection costs of the net wealth tax in terms of its revenue are substantially high compared to other taxes. [i]

In addition, it is not uncommon to find situations where, because of the accumulation of the capital gains tax and the wealth tax, severe liquidity problems arise. Given the confiscatory nature of this tax, taxpayers are forced to sell assets to pay the combined tax liability, which exceeds the gross return on assets.

As to the relevance of the wealth tax as a source of information to reduce income tax evasion, it has been argued that nothing prevents the establishment of a system of compulsory wealth declaration without the need to tax wealth.

Moreover, historically, the capacity of net wealth taxes to provide tax resources has been demonstrated to be weak. Even though the introduction of the NWT increases the progressivity of the tax system, its redistributive capacity is limited due to the low revenue collection because the tax is levied on a small taxpayer base. In addition, tax rates must necessarily very be low if confiscatory effects are to be mitigated. One of the lessons that the theory of optimal taxation solidly established in the 1980s is that, beyond a certain level, increasing progressivity undermines the trade-off between efficiency and equity.

In addition, the tax gap (the difference between the actual taxes collected and those which would be collected under full compliance) tends to be high when it comes to the NWT. Policymakers need to be aware that tax revenue from the NWT is not simply the result of applying a tax rate to the pre-existing level of wealth, and not only because of tax avoidance and evasion behaviours. Individuals may adjust their taxable wealth in response to the tax. Changes in taxpayers’ decisions will lead to economic inefficiency and, because various tax bases are reduced, overall tax revenue will also decrease in the medium term.

One possible response of taxpayers to the introduction of a NWT is to leave the tax jurisdiction. Emigration of the wealthy is a very real threat that compromises the objective of taxing wealth, especially in an era of increasing globalisation and mobility of the highly skilled. The tax authority can always tries to put obstacles to tax migration. For example, to accept non-resident status, in addition to the objective criterion of the number of days spent in the destination jurisdiction it may consider a subjective criterion regarding whether the jurisdiction of origin continues to be the centre of interest of the taxpayer leaving the country. It can also establish exit taxes. However in the end, in a free country, the conflicts derived from these measures only make the exit more expensive and taxpayers end up leaving their jurisdiction. Tax-motivated migration harms tax collection. In this context, the ability of governments to implement redistributive policies seems to be limited.

Net wealth taxation and tax strategy

In recent decades, barriers to international mobility of capital and labour have decreased because of the transmission of ideas, meanings and values across national borders and the reduction of transportation costs. Globalisation has reduced both the psychological cost of migration and the cost of adapting to a new working environment, because countries are becoming more like each other. The latter effect occurs because production processes have become more homogeneous, language skills have improved significantly, and barriers to entry have fallen – especially within OECD countries. In such a context, highly skilled workers with high income are more likely to vote with their feet in response to high taxes. In addition, more productive individuals are likely to have more attractive outside options. More recently, the spread of remote working has reinforced this possibility. There is evidence that wealth taxes have a significant impact on the relocation not only of financial assets but also of individuals. It is expected that net worth taxes tend to have a greater offshoring impact on the more integrated regions, such as the EMU. In a context of open borders and tax competition for income and savings, governments may engage in a race to the bottom in tax rates to attract mobile assets and activities. The extent of this effect depends on the degree of resource mobility and the asymmetry in the size and per capita income of tax jurisdictions involved.

As it is difficult to tax net wealth effectively at the national level, advocates of wealth taxation call for international coordination to introduce a minimum tax rate on net wealth. However, when it comes to the NW there is no consensus on the desirability of such international harmonisation. On the one hand, tax competition is seen as a mechanism to mitigate the problem of wasteful public spending. The influence of tax policy on the location decisions of individuals across jurisdictions has been a long-standing debate in public economics. In 1956, Tiebout proposed a model in which consumer-voters’ preferences for public goods are revealed when they vote with their feet in a context where there is full taxpayer mobility and there are sufficient tax jurisdictions. Since the seminal paper by Tiebout, the extent to which tax competition can contribute to improving economic efficiency by creating a quasi-market for public goods has been extensively researched. The mobility of the labour force may be a relevant factor in shaping the optimal tax system and can contribute to economic efficiency. Since high tax rates encourage migration, the resulting loss of tax revenue is widely believed to be an important reason for keeping taxes down. In the presence of interjurisdictional labour mobility, high taxes might act as a catalyst for the high skilled to exit from a region, thereby thwarting the redistributive goals of home government. By forgoing wealth tax revenues and keeping the rates of other taxes low, a jurisdiction may impose on itself the obligation to manage its resources more efficiently. The result is better budgetary discipline, a curb on the expansion of public spending, and improved public finance stability. Thus, the suppression of tax competition, through harmonisation agreements, may translate into inefficiency and reduces the accountability of governments pursuing policies of increasing public spending over time. Tax competition, when it leads to better fiscal responsibility, can even translate into a real improvement in the government’s redistributive capacity, if the positive impact on growth is high enough. Particularly when it comes to a tax such as the one that falls on the stock of wealth, from which a strong impact of economic inefficiency is predicted, tax competition can result in a positive outcome from the real perspective of social policy.

In a world where borders are becoming more open; people, goods, and resources increasingly mobile; and economies more interdependent, many governments have engaged in tax competition strategies to attract taxable resources. When tax expatriates stop paying in their home country the government experiences a loss of revenue. This has led governments willing to defend high taxation status to implement exit taxes. But exit taxes, are controversial, as represent barriers to free movement of persons and capital.

It is difficult to reconcile the objectives of trying to attract talent and investment into a country by rewarding impatriates while at the same time maintaining a somewhat confiscatory wealth tax and a high level of tax progressivity (with obvious inefficient effects). Especially when it comes to countries with a predisposition to make unexpected changes in the tax system, not only will the objective of attracting tax bases not be achieved, but in the medium-term talent and wealth will be expelled. Liberal democracies must achieve an optimal balance to prevent the rich from emigrating while attracting the poor. In a dynamic context, taxing net wealth and keeping tax rates on income of labour and capital too high seems to be incompatible with the financing of social spending policies in the medium term.

[i] It has been counter-argued that digitisation increases the tax administration’s access to information and its ability to handle large amounts of data, thereby reducing compliance and enforcement costs.

Carlos Contreras: Licenciado y Doctor en Economía (UCM) y M.Sc. in Economics (University of York). Profesor Titular de Economía Aplicada (en excedencia). Ha publicado en Review of Public Economics IEF, Revista de Economía Aplicada, Journal of Public Administration, Finance and Law, Applied Economic Analysis, Journal of Infrastructure Systems, Papeles de Economía Española, Información Comercial Española, Journal of Insurance and Financial Management etc. Autor entre otros libros de “El papel del gobierno en la era digital” o “DeFi: ilusiones, realidades y desafíos”.