Autor: Francisco Covas

An important objective of the banking regulations introduced after the global financial crisis was to eliminate the perception that some firms were too big to fail (TBTF). The perception of being TBTF compromises public welfare for two main reasons: first, investors that perceive a firm to be TBTF do not charge appropriately for risk, creating an incentive for the firm to become riskier to take advantage of the subsidy. Second, firms not currently perceived as TBTF have an incentive to become larger and more systemic so that they become TBTF and get the funding subsidy. The dynamics fostered by both reasons also increase the likelihood that the government will, in fact, have to bail out a firm, making the perception of TBTF potentially self-fulfilling.

Numerous steps were taken over the past 10 years to increase the resiliency and the resolvability of one type of potentially TBTF firm: large banks. A study of TBTF by the GAO in 2014 found that GSIBs do not benefit from a funding advantage, but might do so in periods of financial stress2. One reaction to the post-2010 data has therefore been that any judgment on TBTF had to await a time of crisis, when markets would be more likely to internalize and price for the potential benefit of a TBTF government bailout. For these reasons, the COVID-19 pandemic and its economic and financial impacts are an ideal test of the durability of the premise that large banks no longer receive any TBTF market subsidy.

The COVID-19 pandemic sparked a sudden and significant repricing of bank debt in March 2020. This note measures how the pandemic affected bank funding costs, namely the behavior of unsecured bond spreads of US banks during 2020. The data clearly show that the funding costs of those banks most likely to have benefited from TBTF—i.e., the global systemically important banks, or GSIBs—actually increased significantly more than those of other large banks. Those larger increases cannot be attributed to differences in risk profiles or in the characteristics of the bonds. This note focuses solely on U.S. GSIBs because of limits on data availability.

Background

As noted in a recent Financial Stability Board (FSB) report, the FSB developed a set of international requirements designed to eliminate TBTF and address the moral hazard associated with systemically important banks discussed above. First, GSIBs are subject to higher capital requirements to internalize the systemic risk externalities related to their own failure and to reduce incentives to engage in riskier activities. Second, those banks are also now subject to total loss-absorbing capacity (TLAC) requirements. Under those requirements, systemically important banks must hold a certain amount of bail-in able debt, enabling resolution authorities in each jurisdiction to convert those liabilities into common equity if such banks were to fail. And finally, systemically important banks must regularly submit detailed plans (known as living wills) for their orderly recovery.

A corollary of a bank being deemed TBTF is that the risk premium on unsecured debt is not particularly sensitive to changes in the economic outlook. In this context, a straightforward way to investigate the effectiveness of TBTF reforms is to see whether the substantial and unexpected change in risk assessments caused by the pandemic translated into higher-risk spreads of systemically important banks, even after controlling for differences in risk and other important drivers of credit spreads. The results presented here strongly indicate that unsecured bond spreads of GSIBs widened relative to non-GSIB banks during the pandemic. As a result, TBTF reforms have been successful in the U.S. Moreover, we also find that the funding costs of GSIBs were already higher relative to those of non-GSIBs, even after taking into account bank-specific measures of credit risk and liquidity as well as unobserved macroeconomic factors.

GSIB bond spreads widened relative to non-GSIBs spreads during the early stages of the pandemic

To study how the TBTF reforms have affected funding costs for bank holding companies, we gathered data on senior unsecured bond spreads of large banks before and during the early stages of the COVID-19 pandemic. The data source is Bloomberg. The sample of banks includes all eight U.S. GSIBs and all non-GSIBs that are publicly traded banks subject to the 2020 stress tests. We included banks subject to similar capital requirements, apart from the TBTF reforms. The sample consists of 339 unique bonds issued by 22 banks and traded over the first half of 20203.

If there were a funding cost advantage because U.S. GSIBs are perceived to be TBTF, we would expect the option-adjusted spread (OAS) of unsecured bonds issued by GSIBs to be less sensitive to risk relative to those of non-GSIBs at the onset of the COVID-19 pandemic.

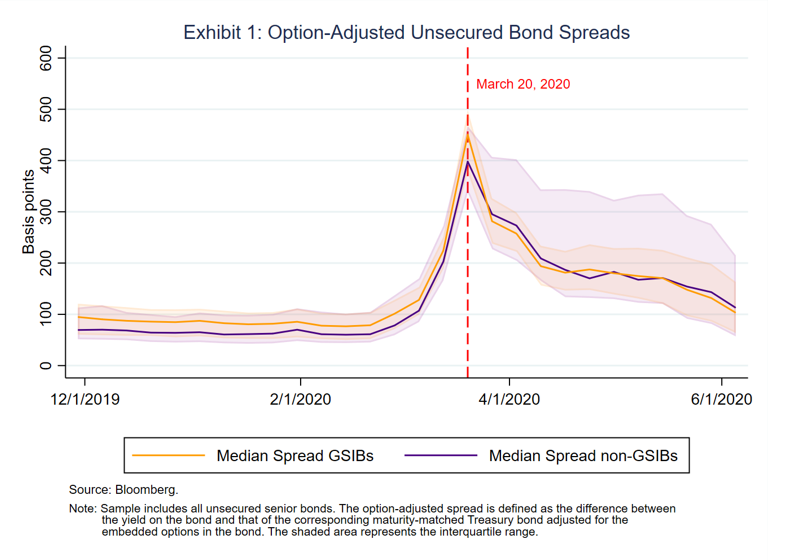

Exhibit 1 shows that median GSIB spread widened by more than the median spread of non-GSIBs in the second half of March before passage of the stimulus from Congress (the CARES Act, which was passed by the Senate on March 25, 2020). At the onset of the pandemic, the median GSIB spread peaked at 450 bps in the week of March 20, while the median non-GSIB bond spread equaled 400 bps that same week, corresponding to a gap in bond spreads of about 50 bps (i.e., median bond spreads widened from 20 bps to 50 bps). In the rest of this post, we show that the observed change in bond spreads is even stronger after the inclusion of bank-specific controls, bond characteristics, and macroeconomic factors.

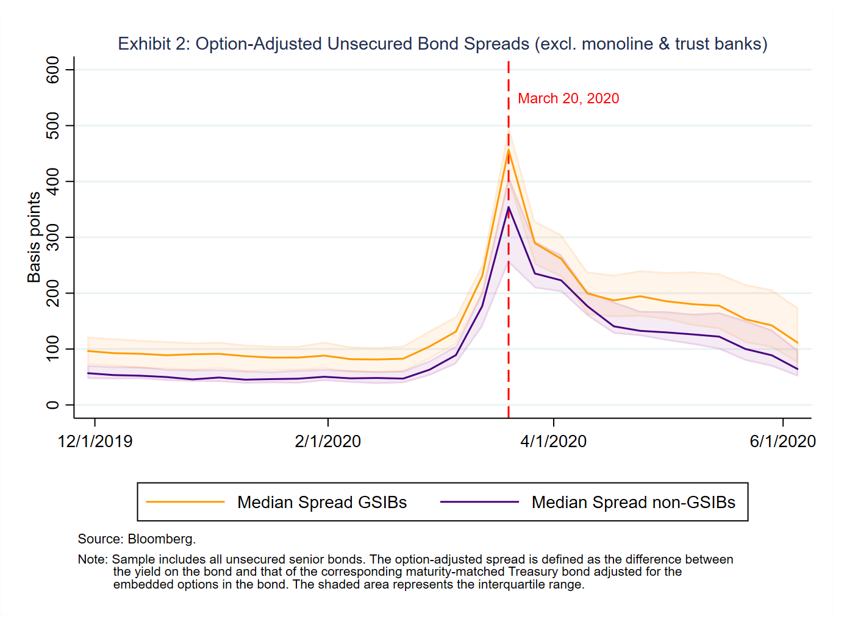

It is also evident in Exhibit 1 that bond spreads of non-GSIBs widened considerably after March 20, 2020. The sample includes several monoline banks that tend to have higher probabilities of default relative to GSIBs. Their funding costs stayed elevated despite the passage of the stimulus from Congress. By contrast, the funding costs of trust banks stayed relatively low, because they do little direct lending to households and businesses. Exhibit 2 plots the median spreads excluding four monoline banks (ALLY, AXP, COF, and DFS) and three trust banks (BK, NTRS, and STT) from the sample. The exhibit shows a more pronounced difference in bond spreads between GSIBs and non-GSIBs. On the week of March 20, the gap in funding costs between GSIBs and non-GSIBs widened by 100 bps, and we no longer see a large dispersion in non-GSIB funding costs after March 20.

Results are robust, controlling for bank and bond characteristics and macroeconomic factors

The COVID-19 event presents an almost unique opportunity to study the impact of TBTF reforms on bond spreads, because it combined a set of important factors. First, absent interventions by the Federal Reserve and stimulus from Congress, the pandemic could have had catastrophic economic consequences. Next, the COVID-19 event was unexpected, and the repricing of risky assets happened very fast. As a result, if the higher risk sensitivity of GSIBs’ unsecured bond spreads relative to non-GSIBs is robust to controlling for bond-specific characteristics, bank-specific controls, and macro factors, this offers strong evidence in support of TBTF reforms. The analysis also allows us to check if the higher funding costs of GSIBs before COVID-19 are robust to these three criteria as well.

Naturally, many other factors are also key determinants of unsecured bond spreads besides TBTF reforms. It is therefore essential to control for those factors in this analysis. In terms of bank characteristics, the probability of a bank’s default is a key determinant of bond spreads (because a higher probability of default should be associated with a higher bond spread). We use a measure of a 1-year probability of default from Bloomberg, based on a proprietary proxy of Merton (1974) distance-to-default measure. Next, we control for bank liquidity as defined by the ratio of high-quality liquid assets to total assets. Finally, the regression also includes as controls an accounting measure of bank profitability, the common equity Tier 1 capital ratio, as well as loan loss provisions as a share of total loans.

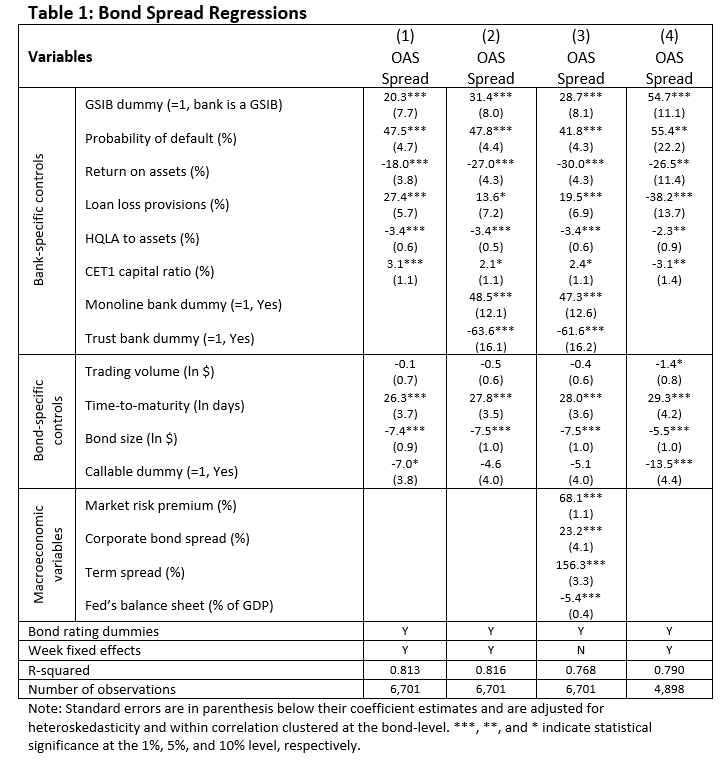

The regression results are shown in Table 1 across four different regression specifications. The results reported in the first three columns include all banks in our sample, and the specification presented in the last column excludes the monoline and the trust banks. To mitigate endogeneity concerns, all bank-specific controls lag either 4 weeks or 1 quarter, depending on the data’s frequency.

Most regression coefficients have the expected signs. The coefficient on the probability of default is an economically important and highly significant predictor of bond spreads. For example, a 1-percentage point increase in the probability of default implies a nearly 50-basis-point increase in funding costs. We also find a significant inverse relationship between bank profitability and bank liquidity and bond spreads. Interestingly, the common equity Tier 1 ratio has a positive sign in the first, second and third columns, but that likely reflects the higher regulatory capital ratios of monoline banks. When monoline and trust banks are excluded from the sample, as shown in the last column, we find an inverse relationship between the regulatory capital ratio and funding costs. This implies that firms with higher regulatory capital ratios pay less for their unsecured debt. Finally, there is generally a positive relationship between loan loss provisions and funding costs4.

Across all model specifications, there is a positive relationship between a bank being a GSIB and its funding costs. The magnitude of the difference varies from 20 basis points in column 1 to 55 basis points in column 4. Since GSIBs are subject to long-term debt requirements and such debt must be converted to equity when a bank fails, GSIBs are always subject to higher funding costs, regardless of the level of economic distress.

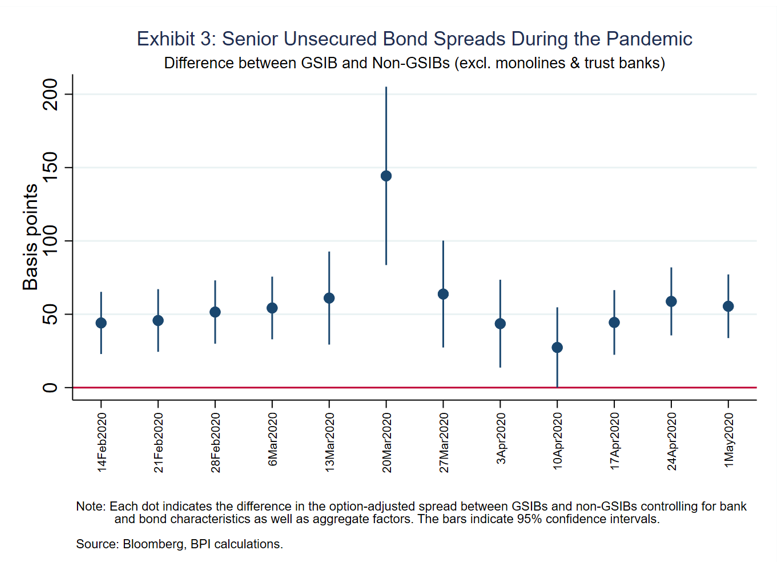

Exhibit 3 shows the difference in funding costs between GSIBs and non-GSIBs in the weeks before the start of the pandemic and then after the passage of the stimulus package from Congress. The results are based on the model specification reported in column 4 of Table 1. Before the start of the COVID event, the difference in bond spreads between GSIBs and non-GSIBs was close to 50 bps and statistically different from zero. In the following weeks up to March 20, 2020, and after it was apparent the pandemic would have severe economic consequences without government intervention, the difference in unsecured bond spreads increased rapidly to nearly 150 bps. After the passage of the stimulus package by Congress, the difference in funding costs declined to 64 bps and down to nearly 50 bps in the week of April 17. After that week, the difference in unsecured bond spreads remained close to 50 bps, about the same difference in funding costs between GSIBs and non-GSIBs estimated before the start of the pandemic.

Although the rise in funding costs was relatively short lived, largely due to the stimulus from Congress and the Federal Reserve’s intervention in financial markets, it shows that the spreads of unsecured bonds issued by GSIBs reflected a higher risk sensitivity than the debt issued by non-GSIBs. Moreover, the higher increase in GSIBs’ funding costs relative to non-GSIBs during the early stages of the crisis suggests that 1) market participants believe that GSIBs are riskier; and 2) market participants are not pricing in an implicit government subsidy as part of GSIBs’ unsecured debt.

TBTF reforms are working well, since the evidence shows that investors do not believe U.S. GSIBs will be bailed out

In this post, we have used the repricing of financial assets during the pandemic’s early stages to evaluate the TBTF reforms. As noted in the FSB report, the pandemic represents the most critical test to the post-2010 crisis framework. We use the period before the Federal Reserve and the government’s massive intervention to assess the impact of the rapid and severe deterioration in economic conditions on the funding costs of banks. Results strongly indicate that the spreads of GSIBs showed a stronger response to changes in the economic outlook relative to the spreads of non-GSIBs during the early stages of the COVID-19 pandemic. As a result, the funding cost advantages of systemically important banks have disappeared, because market participants see the debt issued by GSIBs as riskier than the debt from non-GSIBs. In addition, consistent with the preliminary findings of the FSB report, we also conclude that funding costs are lower for banks other than the GSIBs in the period before the start of the pandemic. In summary, the results reported in this note demonstrate that the TBTF reforms have worked.

[1] A prior version of “Putting “Too Big to Fail” to Rest: Evidence from Market Behavior in the COVID-19 Pandemic” has been published on the Bank Policy Institute Blog on September 9th 2020.

[2] See General Accountability Office, “Large Bank Holding Companies: Expectations of Government Support,” July 31, 2014; https://www.gao.gov/products/GAO-14-621.

[3] We limited our sample to senior unsecured issues with a fixed coupon schedule. To ensure the results are not driven by very small bond issues, our sample excluded bonds with a par value less than $5 million and all bonds with a remaining term to maturity of less than 1 year. The impact of outliers in our results is mitigated by winsorizing bond spreads at their 99th-percentile values.

[4] This coefficient is more difficult to interpret across the various specifications in Table 1 due to the introduction of a new loan-loss accounting method known as the current expected credit loss standard on January 1, 2020.

Autores:

Francisco Covas is currently Senior Vice President, Head of Research at the Bank Policy Institute. Prior to joining BPI, Mr. Covas served as Senior Vice President and Deputy Head of Research at the Clearing House Association, where he helped oversee research and analysis to support the advocacy of the Association on behalf of the owner banks. Prior to joining the Clearing House in 2016, Mr. Covas was an assistant director of the Division of Monetary Affairs at the Federal Reserve Board.

Gonzalo Fernandez Dionis is Vice President of Research for the Bank Policy Institute. His responsibilities include carrying out economic analysis of banking and financial regulation. His research interests include the shadow banking sector, stress testing and capital and liquidity requirements. Prior to joining BPI, Mr. Fernandez Dionis was vice-president at the Royal Bank of Canada in London where we worked as an equity research analyst.