Autor: Carlos Contreras

Robo-advisors (RAs) are decision support systems (DSS) that promise to provide investment advice in an efficient, rational and transparent manner. The term was first used in 2002 in an article in the Financial Planning Magazine. In 2008 it became a real business model with the launch of the first digital robo-advisor platform. In 2013, robotic advisory became one of the main disruptor factors in the financial industry by integrating artificial intelligence and Fintech into the portfolio management process.

A robo-advisor is AI algorithm-based software that provides automated financial planning. The system can provide a full range of services, including enrolment functionality, analysis of client needs and objectives, asset allocation and portfolio rebalancing recommendations tailored to the client’s profile. The design of the RA’s operating procedure may or may not include the involvement of a human advisor or human relationship manager – human in the loop (HITL)-.

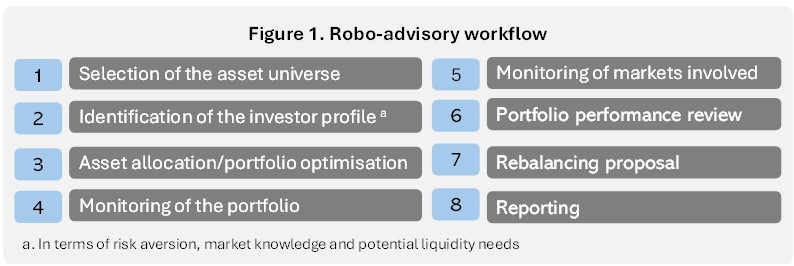

RA systems gather information about a given client’s financial objectives and risk tolerance and can automatically design diversified and balanced investment portfolios tailored to that profile. Algorithms can also automatically adjust the recommended investment portfolio composition to changes in client objectives and/or market conditions. The typical robo-advisor workflow includes selecting the asset universe, profiling the client’s risk tolerance, optimal portfolio building, monitoring investments positions, assessing market trends, reviewing performance, suggesting portfolio rebalancing and reporting. See Figure 1.

The advent of independent digital platforms designed to facilitate efficient and diversified investment with minimal human intervention represents a potentially huge disruption to the asset management industry. While private banking services are expensive and exclusive, robo-advisors are particularly suited to clients with a smaller spending budget than is required to maintain a traditional wealth management advisory service. Automated advisory aims to change this, bringing wealth management to a much wider range of investors at an affordable price.

This is not to say that traditional private banks should not also adopt systems based on artificial intelligence to improve the productivity of their staff, the returns they offer their clients and the quality of their services. The added value of human managers needs to increase in order to differentiate private banking services, and the use of AI-based tools can help achieve this goal. In the near future, hybrid models of robot and human co-operation could be the norm in private banking.

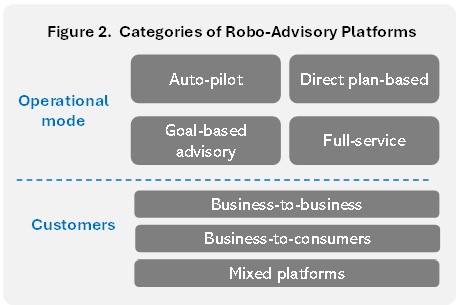

On the other hand, personal banking firms can extend advisory and wealth management services to a lower wealth client base at a satisfactory cost through robo-advisors built in-house or implemented under a white label regime. In this vein, robotic-advisory platforms have been classified into four categories according to their operational model and three categories according to the type of clients they serve. See Figure 2.

To attract a critical mass of customers and build brand reputation, business-to-consumer robo-advice platforms need to invest in proprietary technology as well as advertising. Other types of platforms allow traditional financial advisory and wealth management firms to access their technology in the form of software-as-a-service. Such platforms, typically referred to as business-to-business (B2B), invest considerable sums in technological infrastructure not merely to be able to provide the advisory service to end clients, but also to ensure that corporate clients can connect with their systems. Finally, some platforms adopt a dual approach, combining the pursuit of retail customers with the provision of white label services to other entities. It is inherently challenging to pursue the acquisition of one’s own clientele while simultaneously providing corporate services to entities that are, in fact, direct competitors.

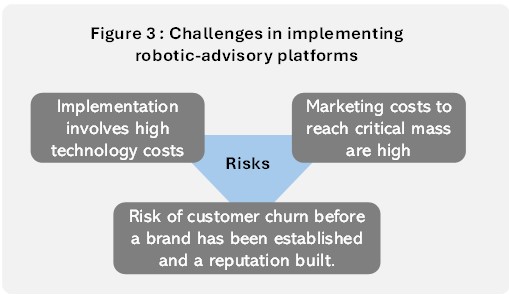

In the preceding decade, the number of robotic-advisory platforms has increased exponentially, evolving from a small number of fledgling enterprises to a well-established and rapidly expanding sector of the wealth management industry. The principal benefit of robo-advice platforms is that they are, by their very nature, digital from the outset. Additionally, they are not encumbered by the difficulties associated with legacy databases that are typically unstructured and incomplete. Nevertheless, those tasked with developing RA platforms must overcome significant challenges, including the generation of sufficient revenue to offset the high costs of implementation and the risk of early customer attrition. See Figure 3.

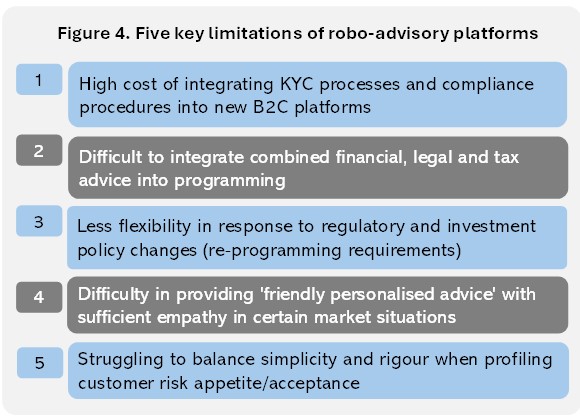

All advisory and investment managers are subject to legal obligations relating to both fiduciary duties, including those set out in MiFID II in relation to consumer protection, and the protection of fair competition. It is therefore imperative that robo-advisory service providers adhere to these standards. In this context, the decision to launch robotic advisory platforms necessitates consideration of the inherent limitations currently faced by this form of financial advice service provision, as illustrated in Figure 4.

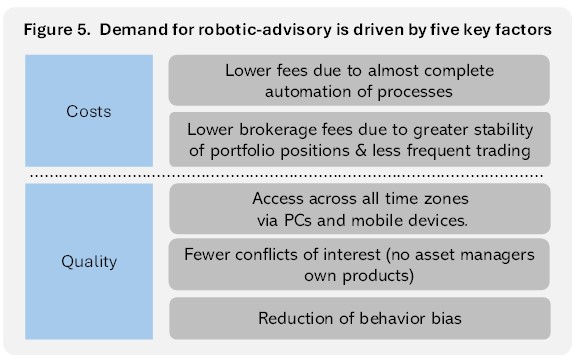

From the demand side, the advantages that justify the huge growth of the robo-advice segment are varied and include, among others, a favourable quality-to-cost ratio for the user, convenience and ease of use, an attractive user experience, complete accessibility, and the absence of conflicts of interest. See Figure 5.

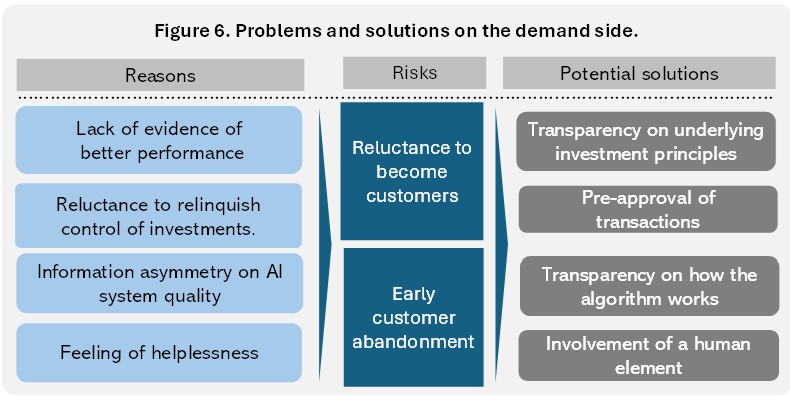

Nevertheless, the growth in demand for automated financial advisory services encounters some resistance from prospective clients. These individuals express uncertainty about the efficacy of the system in terms of investment performance, and reluctance to relinquish control of their investments in favour of a machine whose algorithm they are unfamiliar with. Some customers also may feel helpless during the investment process. In this context, AR platforms are offering a range of solutions. See Figure 6.

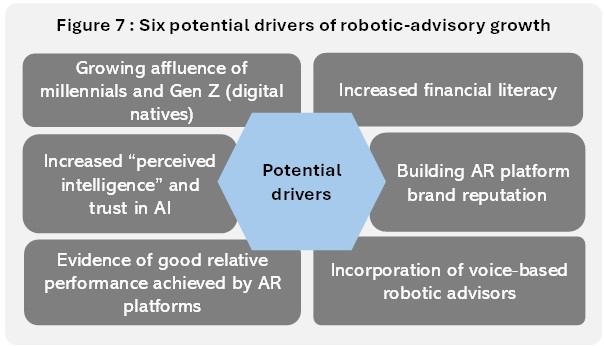

It is expected a notable surge in demand for automated financial advisory services in the coming years because of the growing affluence of the millennial and Z generations, who are already adept at navigating digital platforms, coupled with the expansion of new platforms, the increasing trust placed in AI-based systems by customers, and the progressive incorporation of voice-based robotic advisors. See Figure 7.

The deployment of automated portfolio managers could facilitate the alignment of a growing demand with an initially inelastic supply of these services. RAs may become the preferred investment solution for retail clients or those who are particularly sensitive to the cost of services, as well as gaining importance in the wealthy and high net worth individual segments. By forming strategic alliances with fintech firms and acquiring AI companies, traditional banks and wealth managers can position themselves to offer robo-advisory services.

Autor: Carlos Contreras: Licenciado y Doctor en Economía (UCM) y M.Sc. in Economics (University of York). Profesor Titular de Economía Aplicada (en excedencia). Ha publicado en Review of Public Economics IEF, Revista de Economía Aplicada, Journal of Public Administration, Finance and Law, Applied Economic Analysis, Journal of Infrastructure Systems, Papeles de Economía Española, Información Comercial Española, Journal of Insurance and Financial Management etc. Autor entre otros libros de “El papel del gobierno en la era digital” o “DeFi: ilusiones, realidades y desafíos”.