Autor: Francisco J. López Lubian

Introduction

Everybody agrees: digital world matters and valuation matters. But, do we know how to match properly digital world and valuation? Not always, according to most experiences of digital enterprises in financial markets.

It will suffice to remind what happened in the majority of the IPOs launched by tech companies in 2018 and 2019.

For example, the IPO of Farfetech, the online giant of personal luxury goods. In its market debut, September, 21st, 2018, the price of the shares jumped at $27, with an intraday high of $30.6. One month later, the price was $20. More recently, at the end of January 2023, a private company like Stripe has been reduced its internal valuation by 40% in the past six months.

For digital companies, market prices and initial valuations seem to be playing different games.

Why? Are digital companies living in a different world that the one assumed in traditional valuation methods? Are these traditional methods still valid to catch the economic value reflected in a digital world? How can we know whether a market price of a digital company is a reasonable price? How digital companies can be valued?

Since both digital and valuation matter, it also matters to have reasonable answers to these questions. In this article, we intend to shed some light on these issues.

Innovation and digital world.

The future of countries, business, and individuals will depend more than ever on whether they embrace digital technologies. These days, every company either is or must become a digital organization if it wants to survive and grow in the age of platforms and networks.

To cope with the digital revolution, innovation is needed more than ever. Companies need to constantly innovate to keep pace with ever-changing consumer demand. Innovation implies investment to offer new product/services, using existing technologies or developing new ones.

These investments can be developed in-house and/or through the acquisition of existing companies. In any case, like in any investment decision, they need a correct analysis about their economic sustainability. Economic sustainability implies economic feasibility and economic profitability, as a way to create economic value.

In summary: in a digital world, innovation is crucial to survive and implies investments which need to be valued. To estimate a reasonable economic value it is crucial to focus the valuation. Since we want to estimate reasonable values associated to innovation, let’s start by focusing innovation.

The innovation map

Innovation is vital for any company in order to survive. But, what do we mean by innovation? Do we have different types of innovation?

Any innovation includes three elements:

- New products/ services

- New Markets

- New Technologies

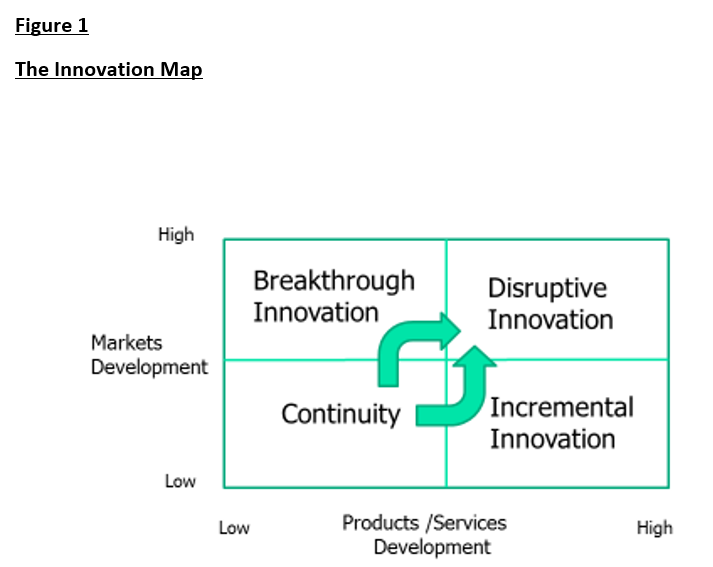

Based on these factors, and for the purpose of valuation, we can categorize different types of innovations, as follows:

- Incremental innovation, where the emphasis is put on the development of new products/services, for existing markets and a given technology. For example, new versions of existing products.

- Breakthrough innovation, where the emphasis is placed on the development of new markets, for existing products/services and a given technology. For example, the extension of Fintech to Health Tech.

- Disruptive innovation, where the emphasis is laid on the development of new technologies, which generate new services/products and new markets. An example, Internet.

Following these categories, any company can determine its innovation map, relating business and innovation, as shown in Figure 1.

Note that:

- This innovation map can be referred to the present situation and/or a future (expected) situation, including one or different business.

- Innovation map changes with time and market circumstances.

- Types of innovations also change with time and market circumstances.

- Disruptive innovation implies development of new technologies.

- Breakthrough and incremental innovations become disruptive by developing new technologies.

The innovation map can become a powerful tool to analyze and develop business strategies.

Linking Economic Value and Innovation

After focusing innovation, let’s comment some issues about economic value. Are traditional valuation’s models still valid to estimate the economic value of innovation?

As known, there are two ways to measure economic value. First, the extrinsic economic value, which is an economic value derived from what market dictates. Second, the intrinsic economic value, where we try to catch the economic value based on the future business plans.

In terms of intrinsic (fundamental) economic value, the lack of operational flexibility in the traditional Discounted Cash Flow (DCF) approach can lead to an underestimation of the economic value associated to some investments, especially when a business model is based on an effective management of future risks and rewards based on innovation.

Operational flexibility reflects the fact that nobody will keep a present decision in the future, no matter what happens in that future. In fact, future is not deterministic (as assumed in a traditional DCF approach), but probabilistic and open to different alternatives.

This is what happens in a digital world. In this case, the higher the degree of disruption in the expected innovation, the higher the importance of operational flexibility to create economic value.

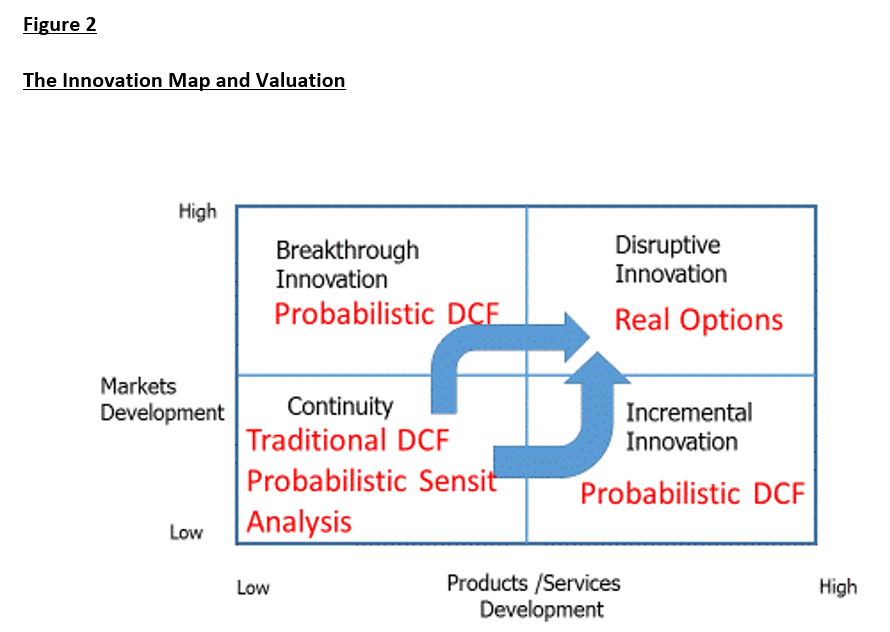

How can we introduce the value of this operational flexibility in the traditional way (DCF) to measure economic value?

Basically, by [1]:

- Setting up different scenarios with different probabilities (probabilistic sensitivity analysis).

- Transforming some of the variables from deterministic to probabilistic, and forecasting a probabilistic DCF value based on simulations (like MonteCarlo model).

- Introducing the economic value of some real options associated to the business model.

Keeping these facts in mind, we can determine how to link these valuation approaches with the innovation map, as shown in Figure 2.

In summary, to catch the expected economic value coming from innovation we need to complete the economic value estimated through a traditional analysis of DCF in a situation of continuity, adding up a reasonable estimated value due to the operational flexibility.

A framework for Valuing Innovation

Following this approach, we propose to valuate any company[2] considering two components:

- The economic value of the company without disruptive innovations.

- The economic value of the expected disruptive innovations of the company.

Accordingly, the total economic value of any company will be the sum of these two components.

To estimate a reasonable value for the first component we can use both extrinsic (relative) value and intrinsic (fundamental) value based on the traditional DCF approach, complemented if needed with probabilistic scenarios and simulations.

To estimate a reasonable value for the second component we have to consider the economic value coming from the possible success of any disruptive innovation of the company. Of course, nobody knows whether any future disruptive innovation will have success, but, if this happens, everybody would like to have the option of being part of the company.

Consequently, the value of any future/expected disruptive innovation in any company is similar to the value of the option to be part of that company, at a given price and in an agreed future, in case that the company will have success developing this disruptive innovation.

The higher the relevance of disruptive innovation in the future of a company, the higher the importance of the second component on its expected economic value. In some extreme cases, all the expected value can come from this second component.

Putting this framework into practice

Since any valuation is just an opinion, what matters in a valuation is whether that opinion is reasonable, or not. Using the proposed valuation framework helps to determine the reasonability of any valuation, avoiding unnecessary black boxes.

To apply this valuation approach, we should:

- Set up the innovation map of the company, present and expected. Identify the expected evolution of your present and future business in terms of innovation.

- Valuate accordingly, estimating the expected value of the company without disruptive innovations, and the economic value of the expected disruptive innovations.

- Apply this approach to all relevant business units or projects.

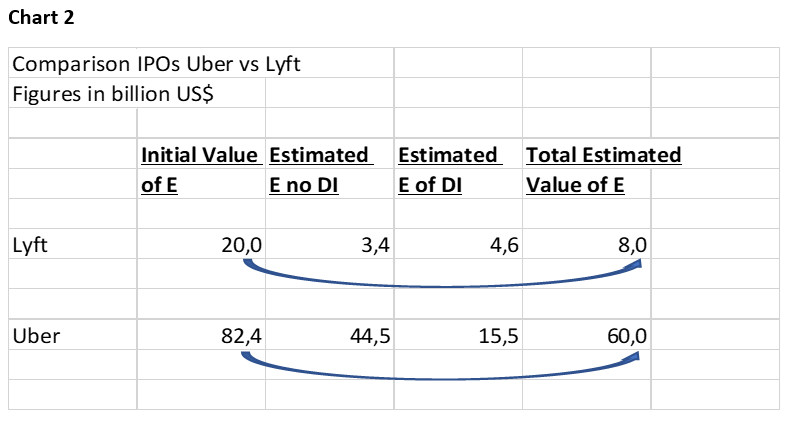

As an example, let’s consider two IPOs launched in 2019: the cases of Lyft and Uber.

Lyft´s IPO was announced at the end of March, 2019. The offer was 30.8 million of shares at a price of $66, which implied that a 10.3% of the Equity had a value of $2 billion. Consequently, the Equity was valued at around $20 billion.

Uber’s IPO was announced at the beginning of May, 2019. The offer was 180 million of shares at a price of $45, which implied that 9.8% of the Equity had a value of $8.1 billion. Consequently, the Equity was valued at around $82 billion.

Are these figures a reasonable value for these companies? How to get a reasonable valuation of these companies?

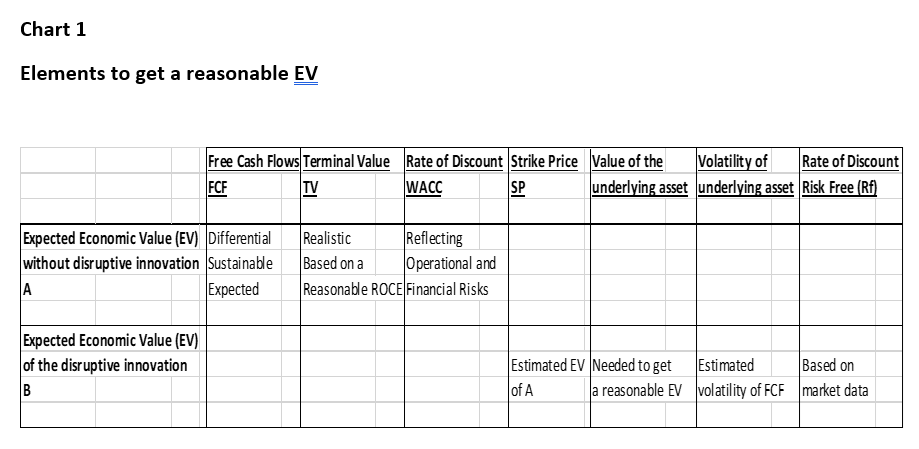

We can separate in both cases the economic value of:

- the company without expected disruptive innovations, and

- the economic value associated to the expected disruptive innovations, estimated as a real option.

To get a reasonable value of A), we should consider that:

- Relevant Free Cash Flows (FCF) must be differential ones.

- Not all relevant FCF are sustainable in time.

- Terminal Value must reflect a realistic economic value of the company last year.

- Rate of discount (WACC)[3] should consider the operational and financial risks of the company.

To reach a reasonable value of B) as a real option, we have to consider that:

- The strike price is the value of A)

- Any estimated value of the company in case of success (estimated value of the underlying asset) should be realistic.

- The volatility of this underlying asset should be similar to the volatility of the FCFs consider in A).

Chart 1 summarizes main elements to be consider in order to get a reasonable value of A and B.

As commented, when disruptive innovation is a key component in the expected economic value of the company, component B) becomes a relevant percentage of the total value. The more the total value of a company depends on B), the higher the importance of using a reasonable and realistic estimated value of the company in case of success.

At the end of the day, if the estimated total value of the company comes basically from the estimated value of the option, the key question is: would you pay that, for that option?

Chart 2 shows the estimated reasonable maximum values of both companies, applying this approach.

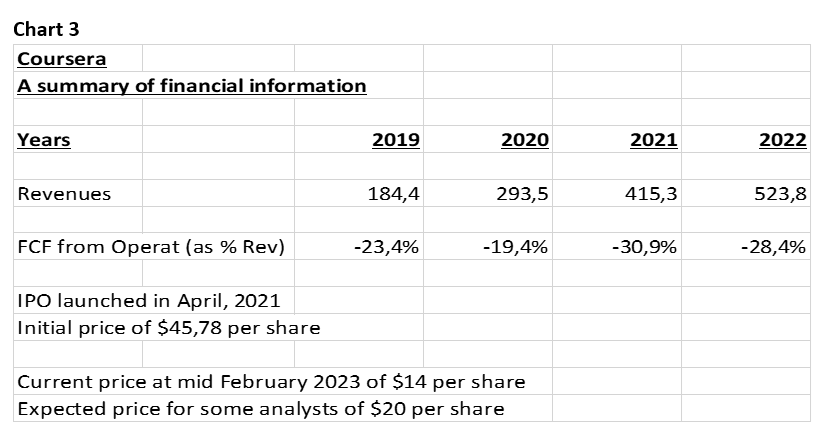

Finally, let’s consider now a more recent case. In mid-February, 2023, there were rumors in the markets about a possible issue of new shares of Coursera, the leading platform for on-line education. Chart 3 summarizes some information of Coursera.

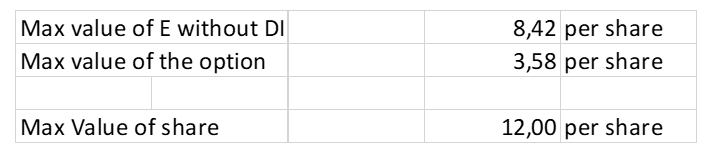

If we apply our methodology, as summarized in Chart 1, to estimate a long-term reasonable value for Coursera, we get a maximum price of $12 per share, broken down as follows:

Summary

- Companies need to constantly innovate to keep pace with ever-changing consumer demand. Innovation implies investment to offer new product/services, using existing technologies or developing new ones.

- These investments need a correct analysis about their economic sustainability. Economic sustainability implies economic feasibility and economic profitability, as a way to create economic value.

- To estimate a reasonable economic value it is crucial to focus the valuation.

- To focus innovation we propose to determine the innovation map, relating business and types of innovations.

- To catch the expected economic value coming from innovation we need to complete the economic value estimated through a traditional analysis of DCF in a situation of continuity, adding up a reasonable estimated value due to the operational flexibility.

- Based on that, we propose to valuate any company considering two components:

- a) the economic value of the company without disruptive innovations;

- b) the economic value of the expected disruptive innovations of the company.

Accordingly, the total economic value of any company will be the sum of these two components.

- To apply this valuation approach, we should:

- Set up the innovation map of the company, present and expected. Identify the expected evolution of your present and future business in terms of innovation.

- Valuate accordingly, estimating the expected value of the company without disruptive innovations, and the economic value of the expected disruptive innovations.

- Apply this approach to all relevant business units or projects.

[1] See “Principles of Corporate Finance” Brealey, Myers & Allen. Mc Graw-Hill, 2015.

[2] Or project/business idea

[3] Weighted Average Cost of Capital

Autor:

Francisco J. López Lubián es profesor asociado del Área de Finanzas del IE Business School.

Especialista en Valoración y Análisis Financiero, el profesor López Lubián es profesor visitante del International MBA de Hult Business School, del MBA de la Universidad Adolfo Ibáñez de Chile y del Master en Finanzas de la Universidad San Andrés de Argentina, del EMFI del INCAE (Costa Rica) y del Master en Finanzas de la Universidad EAFIT (Medellín, Colombia).